Un cable filtrado por Wikileaks revela la preocupación que causó el aumento de un impuesto del 5 al 10 por ciento sobre la minería. Se incluyen los cables diplomáticos utilizados para este artículo.

Un cable filtrado por Wikileaks revela la preocupación que causó el aumento de un impuesto del 5 al 10 por ciento sobre la minería. Se incluyen los cables diplomáticos utilizados para este artículo.

Por Santiago O’Donnell publicado en el diario Página/12

13/03/2011. Aunque el sector minero no paga retenciones del 35 por ciento como algunos productos agrícolas, ni del 45 por ciento como pagan las petroleras, y aunque en los últimos años el precio internacional de los minerales trepó a picos históricos, la Embajada de los Estados Unidos reaccionó ante el aumento de un impuesto del cinco al diez por ciento alertando sobre el fin de las inversiones en la Argentina.

Según un cable diplomático de octubre del 2007 filtrado por Wikileaks al que tuvo acceso Página/12, la embajada sondeó a distintos empresarios mineros sobre la continuidad de sus inversiones en el país y se hizo eco de sus quejas, a pesar de que las inversiones estadounidenses en la minería argentina son escasas.

La intervención de la embajada tuvo lugar después de que “contactos del sector privado” que no identifica alertaran de que el nuevo impuesto “socavaría las inversiones del sector minero y el clima de inversiones en general en la Argentina”, dice el cable firmado por el entonces embajador Earl Anthony Wayne.

Sin embargo, en los sondeos de la embajada ningún representante del sector se mostró dispuesto a retirarse del país ni a quejarse ante el Gobierno por el gravamen impuesto, quizá porque el margen de ganancia aún era amplio.

El impuesto a las exportaciones mineras que provocó la reacción de la embajada forma parte de una tendencia mundial. Según un artículo de Pablo Maas en Clarín de septiembre pasado, los gobiernos de Chile y Australia lo hicieron.

“Alrededor del mundo, está creciendo lo que los propios mineros llaman el ‘nacionalismo de los recursos’. Se trata de gobiernos, nacionales o locales, que están buscando participar con una mayor porción de la renta minera, que se ha disparado al compás del ascenso meteórico de la cotización de metales como el oro, la plata y el cobre”, dice el economista.

Mientras en Australia el nuevo gobierno impuso un gravamen del 30 por ciento a las “ganancias extraordinarias” de las mineras y en Chile Sebastián Piñera mandó un proyecto para aumentar las regalías a un mínimo de cinco por ciento, en la Argentina, hasta el impuesto que preocupó a la embajada, las mineras sólo pagaban regalías del tres por ciento a las provincias. Más aún, la ley minera de 1993, promulgada por Carlos Menem, les otorgó a los proyectos una deducción del 100 por ciento de los gastos de exploración e importaciones sin aranceles, entre otros incentivos, sin contar un compromiso de 30 años de estabilidad fiscal, que en la práctica duró catorce.

“Régimen de primer nivel”

El cable reconoce que antes de la instauración del impuesto la situación de las mineras que operan en la Argentina era prácticamente inmejorable.

“Contactos del sector privado e informes de los medios han sido más bien críticos con la manera en que el gobierno de Argentina aplicó el impuesto, argumentando que efectivamente clausura una década y media de inversión minera con un régimen impositivo de primer nivel mundial”, dice el texto.

A pesar del tono alarmista del despacho diplomático, los mismos “contactos” que se quejaron ante la embajada admitieron que el alto precio de los minerales cubría sobradamente el costo del impuesto, dice el cable: “Contactos del sector minero reconocen que la presente fortaleza del precio mundial de los minerales, particularmente del oro y del cobre, es un incentivo fuerte para permanecer en la Argentina”.

Para que no queden dudas, el autor del cable escribió que en los tres años previos a la aplicación del impuesto de 5 al 10 por ciento, el precio de los principales minerales que exporta la Argentina habían subido un 20 por ciento en el caso del oro y un 60 por ciento en el caso del cobre.

El cable también señala que la presión impositiva sobre la minería sigue siendo baja con respecto a otros productos primarios que exporta la Argentina. “El impuesto federal a las exportaciones mineras ha aumentado sustancialmente, de 0 a 5-10 por ciento, pero sigue siendo significativamente más bajo que las retenciones que se aplican a sectores agrícolas (alrededor del 28 por ciento para la soja) y a los hidrocarburos (alrededor del 45 por ciento para el crudo).”

Intereses

Sin embargo, según la embajada, la decisión de Argentina de aplicar el impuesto afectaría los intereses estadounidenses porque empresas norteamericanas son proveedoras de las mineras. “Comparados con otras firmas mineras basadas en el exterior, los intereses mineros de Estados Unidos son pequeños… Estados Unidos tiene intereses más grandes en la venta de equipos a empresas mineras operando en la Argentina, con cerca del 30 por ciento del mercado. El Servicio de Comercio Exterior estadounidense estima que en el 2006 las exportaciones de equipos mineros (a la Argentina) fueron de cerca de 125 millones de dólares. Estas exportaciones podrían verse afectadas si el nuevo impuesto minero resulta en menos inversiones.”

Según cuenta el cable, al sentirse afectada en sus intereses la embajada intentó contactarse con funcionarios argentinos para pedirles “explicaciones” sobre la decisión de aplicar el impuesto. Pero los diplomáticos fracasaron en el intento.

Así es la queja: “La Embajada ha intentado sin éxito una entrevista con el secretario de Minería Jorge Mayoral, con quien disfrutamos de una buena relación de trabajo, para que nos dé una explicación más completa. Otras embajadas cuentan lo mismo. Llamados y pedidos de reuniones por parte de la Embajada –con varios funcionarios de primer nivel del gobierno de Argentina e incluso gobernadores– han sido mayormente rechazados o no contestados”.

Los cables utilizados

INTERIOR FOR USGS STEVEN ANDERSON

TREASURY FOR LTRAN AND MMALLOY

E FOR THOMAS PIERCE

PASS FED BOARD OF GOVERNORS FOR PATRICE ROBITAILLE

PASS USTR FOR DUCKWORTH

USDOC FOR 4322/ITA/MAC/OLAC/PEACHER

US SOUTHCOM FOR POLAD

E.O. 12958: N/A

TAGS: ETRD, EINV, ECON, PGOV, ENRG, AR

SUBJECT: Argentina Imposes New Mining Export Tax

1. (SBU) SUMMARY. The GOA has imposed a comprehensive 5-10% tax on mineral exports as one of a number of recent measures designed to boost Argentina’s primary fiscal surplus. The measure represents a significant departure from Argentina’s 1993-era mining law, which includes provisions for royalty payments to provinces but otherwise guarantees tax stability for 30 years. The sudden and non-transparent method in which it was enacted – not by law or decree, but via instructions from the Internal Commerce and Mining Secretaries to GOA customs – also unsettled investors. Private SIPDIS sector contacts strongly reacted against the tax, and predicted it would undermine mining sector investment and Argentina’s overall investment climate. Argentine mineral exports are expected to grow 18% in 2007 to reach a record US$3 billion and new mining investments of $2.9 billion are anticipated this year. While US mining interests here are small(Idaho’s Coeur d’Alene mines silver in Santa Cruz province and North Carolina’s FMC extracts lithium in Catamarca province), we are a major exporter of mining equipment used here. Investment in Argentina’s promising gold and copper reserves is dominated by British, South African, Australian and Canadian companies. END SUMMARY.

—————-

A New Tax on Mineral Exports

—————-

2. (U) On November 30, the GOA imposed a 5-10% federal tax on the mineral exports of 14 companies that had previously been exempted from export taxes. This tax, which the GoA only officially announced December 4, is in addition to the existing 3% provincial royalties on the value of gross mineral output. According to private sector contacts, mining companies who had presented export documentation to Aduanas on December 3 were taken by surprise by the new tax. Four of the 14 firms were immediately affected – Borax Argentina, Procesadora de Boratos Argentinos, U.S.-based FMC’s Minera del Altiplano and Minera Alumbrera – and the remaining 10 mining firms who had been exempt will reportedly soon also face this tax. (Media reports from earlier in November had speculated that the measure would only cover copper and gold, which have seen major world price increases. However, the announced measure covers all minerals.)

3. (SBU) To attract investment into the capital intensive and highly risky mining sector, an important provision of the 1993 mining law guarantees tax stability for 30 years. So, when minimum 5-10% tariffs were imposed on all Argentine exports in the aftermath of the 2001/2 economic crisis to raise badly needed revenues, already licensed mining operations were exempted. The GoA’s recent expansion of export tariffs to all mining exports appears to contravene stability provisions of the 1993 mining law.

4. (SBU) The GoA’s regulatory rationale for imposing export tariffs on previously exempt companies derives from the Secretary of Mining’s authority to revoke tax stability exemptions for those mining companies who have failed to fulfill investment commitments made when they requested official approval to begin operating. However, in comments to Econoff, the mining companies have roundly rejected this justification. EmbOffs have attended two meetings on this subject, involving about fifteen embassy and company representatives from the US, UK, Australia, South Africa, Switzerland and Canada.

5. (SBU) Private sector contacts and media reports have been largely critical of the manner in which the GoA enacted the tax, which they argue effectively ends a decade and a half of a world-class mining investment and tax regime. According to private sector contacts, Secretary of Internal Commerce Guillermo Moreno wrote directly to SIPDIS GOA Customs Director Ricardo Echegaray, instructing him to immediately impose this new 5-10% tax, i.e, to end the tax exemption that grandfathered companies enjoyed. Echegaray reportedly replied that Moreno had no authority to order this tax. This was followed by another letter to Echegaray, with identical instructions, with the additional signature of Mining Secretary Mayoral. Echegaray accepted this letter and enacted its provisions. Private sector contacts speculate that the GoA chose this measure – rather than pursue a wholesale change of the 1993 law – to allow the GOA to portray the change as no departure from, or violation of, the 1993 law, and so less legally challengeable.

————————————–

Reaction from mining chamber and firms

————————————–

6. (SBU) The national mining chamber (CAEM) stated publicly on December 4 that the tax is in “no way part of the existing law [that specifically guarantees 30 years of investment and tax stability], and threatens legal stability.” Embassy mining sector contacts have privately expressed disappointment and frustration, and contend that the measure will hurt their own operations, the Argentine mining sector as a whole, and Argentina’s overall investment image. A former mining secretary from La Rioja province and the former president of Canada-based Barrick Gold Argentina both said that they were “flabbergasted.” They indicate that their firms will all undergo a major review of their operations and investments. It is too early to know if this new tax will result in any major reduction in inestments or departures, as the media has speculated. Mining sector contacts acknowledge that the present strength of world mineral prices, particularly for copper and gold, is a strong inducement to remain in Argentina (despite the new tax). Private sector contacts also questioned whether the extra GOA revenue anticipated would even materialize.

7. (SBU) Representatives of local affiliates from multinational companies have largely remained silent so far about what responses, if any, they are considering. On December 6, however, U.K.-based Borax Argentina sought an injunction against this action in federal court. The local Xstrata representative (from the joint Swiss-UK Alumbrera gold and copper project in Catamarca province) said that his and other foreign companies are also contemplating legal challenges. At the same time, many company representatives note that any efforts to challenge this could be counterproductive. They note that the GOA would “surely retaliate” with all kinds of “harassments:” customs, environmental and tax related inspections. A unified sector reaction is difficult to envision, since there is a wide variety and size of projects in different stages of development, involving different minerals and provinces, all with their own financial profiles. These same reps indicated that the GOA “will play hardball, and as always, personalize” any resistance to their measures, and that the GOA had already privately warned companies “not to put up a fight.”

8. (SBU) Local contacts speculate that to the extent companies might alter investment plans, it would depend on the mineral involved. Gold and copper producers might find it hard to justify scaling back production while world prices for these products are so high. However, in the case of non-metallic minerals, such as lithium, boron, phosphate, and soda, margins are much smaller. An early test of what effect this new GOA tax will cause might be seen in the actions of the UK-based Rio Tinto potassium Rio Colorado project in Mendoza province, nearing completion in the coming year. Industry reps speculate that if the new export tax proves untenable to their bottom line, Rio Tinto might choose to cut their losses now.

———————————————

Part of a broader GOA tax collection strategy

———————————————

9. (U) The new export tax is only the latest of a series of GOA measures aimed at boosting the 2008 primary fiscal surplus to about 4% of GDP. This action follows similar recent tax increases on agriculture and hydrocarbons exports. According to Ecolatina (a local consultancy), increases of export taxes in agriculture, hydrocarbons and minerals together will bring an additional $2.8 – 3.2 billion (roughly 1.4% of GDP). In the context of the strong increases in prices of minerals that Argentina exports (particularly gold and copper which have increased in value by 20% and 60% respectively in the last three years), the action seeks to retain for the government part of the increased revenue going to the sector. Media estimates for additional GoA tax revenues from this new mining tax alone are in the range of 800 million pesos (about $255 million) in 2008, assuming international mineral prices, particularly for copper and gold, remain stable at current levels. The amount and relative value of these new taxes are telling. The federal mining export tax rate has increased substantially, from 0% to 5%-10% (apart from the 3% provincial royalties), but is still significantly below export tariff rates assessed on agricultural exports (roughly 28% for soy) and hydrocarbon exports (roughly 45% for crude).

————————————

Mining, a star performer (until now)

————————————

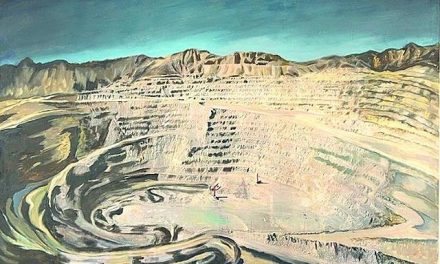

10. (U) Mining activity in Argentina is experiencing unprecedented growth due to high metals prices, large mineral potential, relatively low extraction costs, and – at least up to now – the model 1993 mining law. According to the federal Mining Secretariat, minerals and byproducts exports reached a record $2.6 billion in 2006, and are expected to increase an additional 18% in 2007.

Investments in 2006 alone reached $1.27 billion, up 56% from 2005, and 2007 investments are slated to reach $2.9 billion. The Mining Secretary earlier estimated that the sector will receive $12.5 SIPDIS billion in new investment over the next eight years, as Argentina develops at least 5-10 new major mine projects. According to the Mining Secretary, in 2006 mining provided 37,000 direct jobs and 160,000 indirect jobs, and average monthly wages were about $1550, far above the average national formal monthly wage of about $586. More importantly, a half-dozen projects, with typically one to three decade long projected life cycles, are on the verge of approval and coming on line in the coming year or two. The UK Embassy estimates that current and prospective British mining investments alone are in the $3 billion range.

—————————————

Relatively small U.S. interests at stake

—————————————

11. (U) Compared to other foreign-based mining firms operating in Argentina, direct U.S. mining interests are small. Idaho-based Coeur d’Alene—one of the mining companies that were not exempted from the payment of export tariffs imposed in 2002 — reports that they have invested about $25 million since it began operating its Santa Cruz province-based Mina Martha silver mine in 2001, and employs about 210 workers. (Coeur recently completed a new silver processing facility at this site, in which it invested about $12 million. Semi-processed silver ore was previously exported across the border to Chile for further refining there.) North Carolina-based FMC Lithium has invested about $150 million since 1996 in its Minera del Altiplano site in the northern province of Catamarca, and grossed $58 million in 2006, and employs about 230 workers. FMC exports lithium carbonate and lithium chloride. FMC told EmbOffs that a planned new investment to produce lithium fluoride is now on hold as a result of this new tax. Both companies have privately expressed deep concern about these measures, but so far have not indicated what, if any, actions they might take.

12. (U) The United States has larger interests in mining equipment sales to mining companies operating in Argentina, with about 30% of the market. The U.S. Foreign Commercial Service estimates that U.S. 2006 mining equipment exports were about $125 million. These exports levels could be affected by this new mining tax if it resulted in less investment.

—————————-

Radio silence from the GOA

—————————-

13. (SBU) Embassy has sought without success an appointment with Mining Secretary Jorge Mayoral, with whom we enjoy a good working relationship, for a fuller explanation. A miner by background, he is understood to not agree with this measure. A private sector contact calls Mayoral a “good soldier.” Other embassies report the same. Embassy calls and requests for meetings – with several senior GOA officials and even governors – have been largely turned away or not returned. Following news reports on November 30 that this tax would be imposed, Mayoral canceled a planned breakfast meeting with the UK Ambassador at the last minute.

———————————–

Comment: surprise move will likely hurt mining investment

———————————–

14. (SBU) Although the possibility of a new tax on mineral exports was rumored for some time, the size, scope and manner in which it was enacted has surprised most observers. It is still too early to know if investors will alter their mining activities, but it certainly appears that the measure will be reduce investor confidence in the sector. The mining sector, one of the few that has enjoyed stable and transparent rules of the game, now joins the list of basic infrastructure and natural resource extraction sectors of the economy where GoA interventions and sudden changes in regulatory and tax regimes have made foreign investors think twice before committing long term capital.

WAYNE